Each year, Lab Manager asks its readers about their budgeting and purchasing over the last year and how they forecast budgets in the upcoming year. Encompassing labs from research to clinical, academia to industry, this survey shows the macro trends spanning disciplines that can serve as a useful comparative tool for our readers.

This year’s surveys indicate conservative spending patterns that will likely continue into next year, albeit with some allowance for new projects. Labs are most reluctant to spend money on new equipment, with many preferring to outsource analytical testing instead. The reasons for this are unclear; one possible factor may be a particularly divisive presidential election that leaves labs in limbo until a new president, and accompanying economic policies, are decided.

Demographics

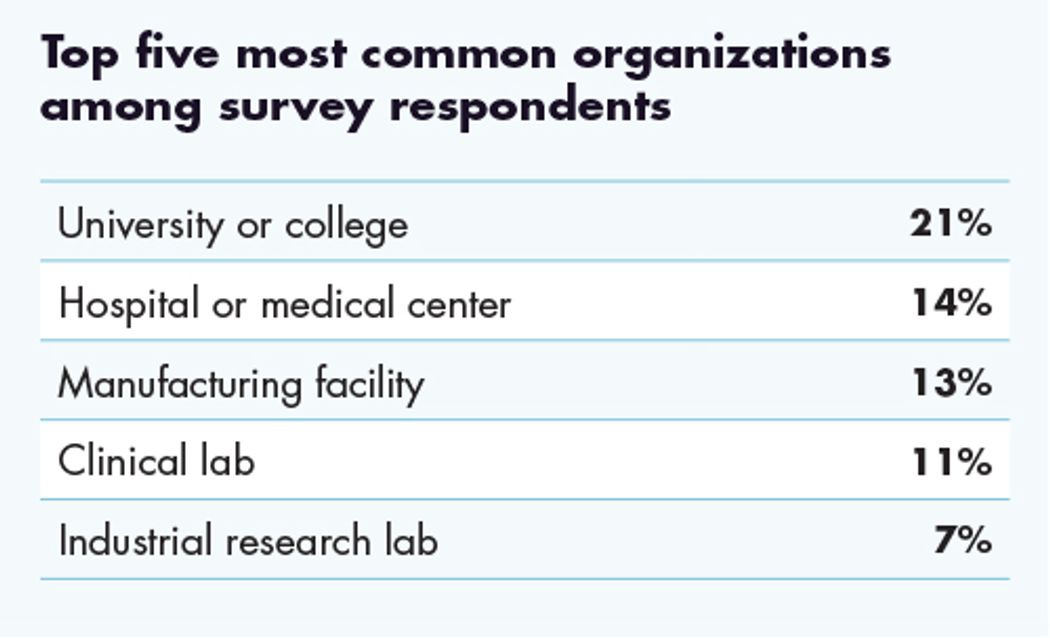

Out of about 150 respondents, the majority of them are responsible for making key decisions in their organizations, holding titles such as lab manager, supervisor, principal investigator, or director. Other important groups represented in this survey include research scientists, QA/QC manager, safety/risk manager, and consultant.

Credit: Lab Manager

Among all these roles, research and development is the most common job function, with quality assurance/control/validation and clinical research/trials following. The least common functions included purchasing and manufacturing/processing and regulatory.

Budget changes over the last year

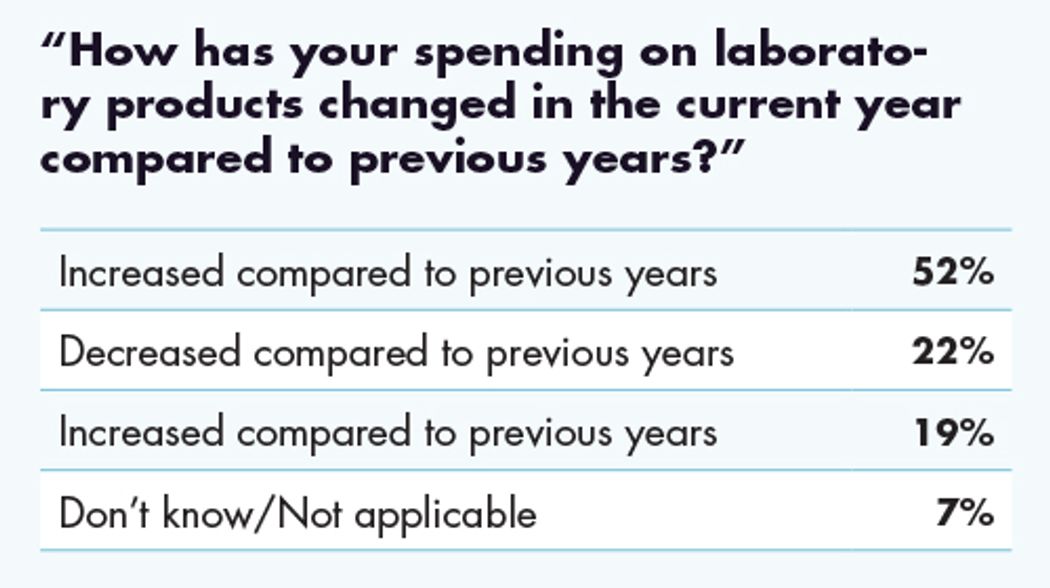

Survey participants were asked how their budgets have changed across 12 areas, including consumables, new projects, outfitting new lab spaces, compensation, outsourcing, and more. The data indicates that research organizations are, by and large, cautiously aiming for growth. Most budgets stayed the same compared to last year, but between a quarter and one-third of budgets increased save for education, outsourcing, and traveling to trade shows/conferences.

Budgets for traveling to trade shows/conferences decreased the most (28 percent.) While some of this may be the result of the current climate of economic uncertainty—common before presidential elections—it’s possible that labs are increasingly opting for virtual events and webinars over in-person ones after they rose in popularity during the COVID-19 pandemic. Google Trends corroborates this idea; searches for the term “webinar” saw a dramatic rise in April 2020 and have continued trending above pre-pandemic levels ever since.

While most labs are not planning to increase their budget for outsourcing, they aren’t planning to scale back on outsourcing, either. Forty-three percent of respondents report that their outsourcing budget will stay the same, and there’s a roughly even split between increasing and decreasing that budget. Considering other information in the survey, it can be expected that analytical testing will remain a heavily outsourced function going into 2025.

Analytical testing tops outsourcing

When asked which activities are being outsourced, analytical testing was the top-reported response by a wide margin at 37 percent, with IT support being the runner-up at 21 percent. Following IT support are several more administrative functions (accounting/payroll at 20 percent, facilities management and human resources both around 15 percent) as well as quality and assurance testing at 17 percent.

The degree to which analytical testing is outsourced highlights a growing trend: labs are increasingly reliant on contract research organizations.

The degree to which analytical testing is outsourced highlights a growing trend: labs are increasingly reliant on contract research organizations (CROs). Venture capital funding in biotech has fallen by $7 billion from Q1 2021 to Q1 2023.1 Furthermore, R&D costs for biologics grew to occupy 46 percent of the pipeline in 2023.

Interestingly, while most (between 67 and 91 percent, depending on the equipment in question) have no plans to purchase new analytical or preparative equipment within the next 12 months, 70 percent of respondents report that their budgets for new lab technology are projected to either stay the same or increase in 2025. Consumables and PPE aside, the notable outlier is laboratory software. Only 40 percent of respondents have no plans to purchase software, while the other 60 percent have plans to within the next 12 months. With the advent of commercial artificial intelligence solutions, labs may be looking to increase productivity and throughput with more powerful software augmenting their current hardware.

Considering all this data, along with the increases in new project funding, it seems that organizations are seeking to cautiously grow. But rather than incurring capital expenses by buying new lab instrumentation, labs are choosing to partner with CROs to expand their services.

Factors affecting purchasing decisions

While few respondents have plans to buy new equipment, they did not hesitate to share what factors would affect any purchasing decisions. Here are the top five most important factors:

- Compatibility with current lab equipment

- Price

- Post-sales support, maintenance, and warranty

- Long-term efficiency and operating costs

- Vendor reputation and brand awareness

Interestingly, past purchasing trends surveys have shown price as being the primary factor. It’s possible that as labs become more intelligent and data-driven, it is increasingly necessary that lab assets be able to “communicate.” Siloed assets represent a large barrier to streamlining workflows and enabling holistic, data-driven decisions because data is kept disparate, unable to be contextualized in a full picture of the lab’s status.

Labs forego used equipment, too

Brand-new assets are not the only ones being left on the shelf. Another question in the survey showed that many labs are not buying used lab equipment, either. Forty-eight percent of labs buy no new equipment, while 35 percent do, and the other 17 percent of respondents are unaware if their lab purchases used equipment. While price is the second-highest rated factor in purchasing decisions, the data around used equipment may signal a shift in priorities. When they do purchase new equipment, lab managers may be prizing current-generation equipment that integrates most effectively with their current equipment; the gains from these integrations may outshine the cost savings of buying used, previous-generation tech.

Credit: Lab Manager

Ultimately, these results indicate the importance of purchasing equipment that best suits the lab’s needs and workflows, regardless of vendor.

Forecasting 2025

At this point, labs seem primed to approach 2025 with more or less the same budget allocations as this year. Whether or not these patterns will change when the presidential election is over remains to be seen.

References: