Discovering Energy Underground

Highlighting the contribution of subsurface geological formation evaluation techniques to produce the world’s energy

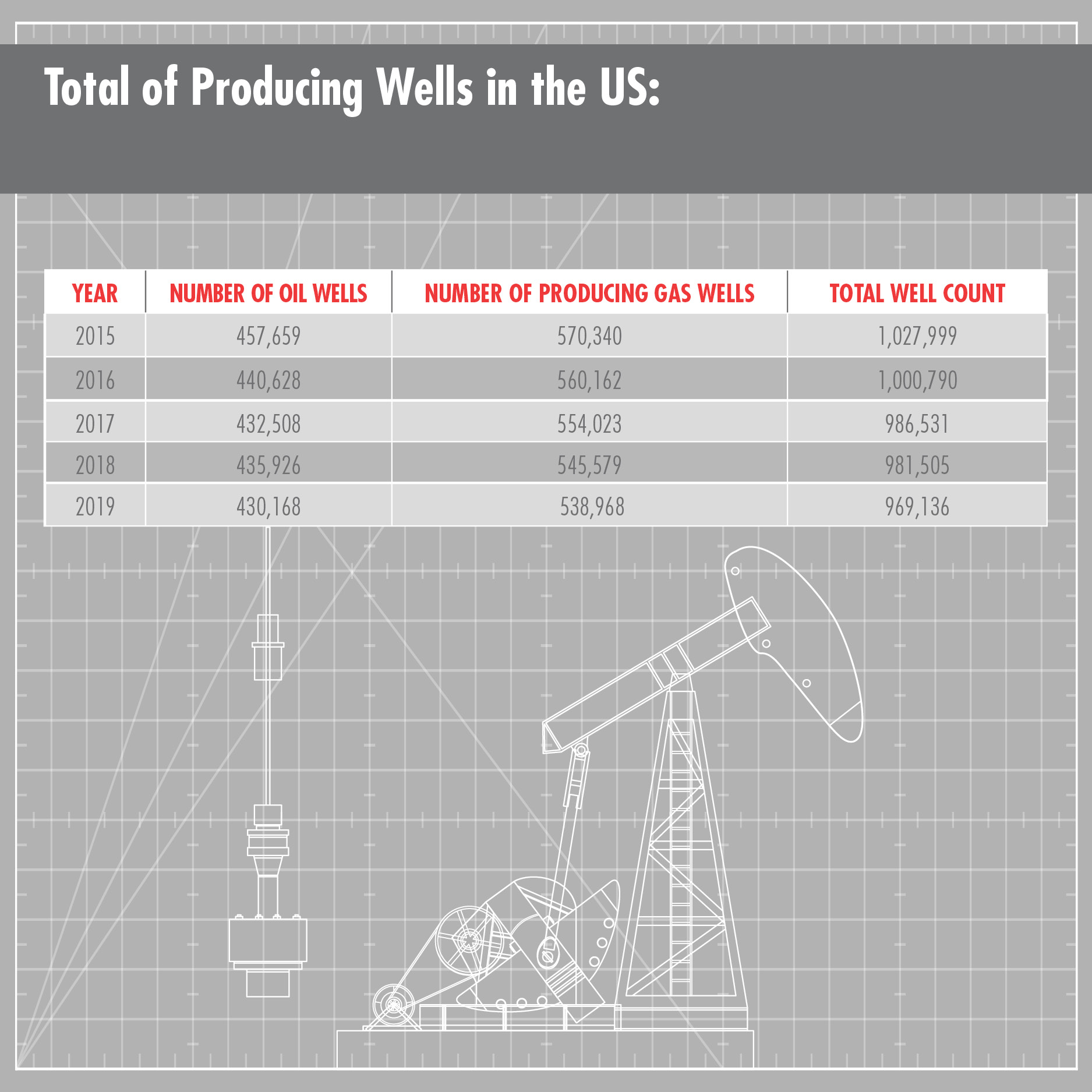

The process to optimize producing oil and gas wells and avoid unproductive ones (also known as dry holes) underpins the success of the global energy industry. With millions of producing wells around the globe, geological service laboratories provide many of the tools and techniques used by energy companies as they pursue safe operations while maximizing profitability.

Lab analysis underpins successful oil and gas operations

Finding new deposits of oil and gas, developing existing discoveries, and optimizing production to maximize the profitability of an oil or gas field are objectives supported by an extensive repertoire of laboratory and field techniques. Each phase in the development of an oil or gas asset is increasingly expensive<em-dash>from acquiring a lease over a prospect, drilling an initial well, installing an appropriate number of development wells, and finally building the infrastructure to connect a development to local and regional transportation. Understanding the risks inherent in each investment decision depends on getting the important elements of the subsurface description correct.

Describing the subsurface in a way that leads to smart business decisions is based on understanding what makes an oil or gas field a commercial success. How large a deposit might be, what product is in the pore spaces of the rock, how connected are those pores, and how will the reservoir perform under production are all fundamental concerns. In the shale fields of the US and Canada, operators must understand how the shale formation will fracture when fluids are pumped into it. All these questions can be addressed using laboratory and field techniques.

Size of the prize: formation evaluation

Oil and gas are stored in the pore spaces of rock layers, referred to as reservoir formations. When the drill bit encounters a prospective reservoir formation in a well, the porosity and permeability of the formation, along with its thickness, are critical information. Porosity is the available storage space in the rock that can be filled with fluids, while permeability relates to how well connected those pore spaces are.

Running data logging tools in the newly drilled wellbore can provide details on the porosity, minerology, and depositional environment based on gamma-ray, resistivity, and other techniques. Permeability usually requires either a drill stem test, where the formation is allowed to flow into the wellbore using a drill stem testing tool (DST), or lab analysis of formation samples extracted from the well. More detailed analysis of porosity is also possible in the lab using extracted formation samples, which can provide insight not possible with field tools.

Once the formation porosity and permeability are understood, an operator must determine how extensive the reservoir formation is. There are many examples where a well has encountered a porous and permeable reservoir, but the reservoir area was too small to support the cost of development. Extent of a reservoir can be determined by the simple, yet expensive process of drilling step-out test wells until you run out of reservoir. More commonly, analysis of extracted core and well logs obtained from an initial well can provide information regarding the environment of deposition of the reservoir. If a well encounters a delta front, like the Mississippi or Nile deltas, the reservoir might be extremely large. If the well encounters a point bar in a river system, the reservoir is likely very constrained. In most cases, a combination of formation evaluation tools and selected step-out wells are required to evaluate a potential reservoir.

Paydirt or disappointment: fluid analysis

Once a porous reservoir section has been encountered by a wellbore, attention turns to what fluid is in the pore spaces. A resistivity log can show the presence of gas, oil, or water<em-dash>hydrocarbons are highly resistive, while salty formation water is conductive. Flowing the formation using a drill stem test can directly recover formation fluids, which can then be evaluated in a lab.

Operators are often very concerned with the quality of the formation fluid recovered. A resistivity log may show the presence of oil, but if the viscosity, quality, or sulfur content demonstrate low value, a reservoir may be uneconomic to develop. Detailed fluid analysis is best performed using extracted samples in a lab setting with techniques such as gas-chromatography mass spectrometry, capillary viscometry, and many others.

Conventional logging tools, core tests, and fluid analysis are generally sufficient to determine the economic potential of a conventional reservoir. These conventional methods have been supplemented in recent years by techniques specific to shale reservoirs.

Breaking rocks: shale reservoirs

In the last 15 years, increasing volumes of oil and gas have been extracted from shale reservoirs. Shale formations were previously thought to be so lacking in porosity and permeability that they were considered as seals holding hydrocarbons in conventional reservoirs. Hydraulic fracturing<em-dash>using massive pumps on the surface with complex subsurface drilling techniques and completion tools<em-dash>has changed this picture. Today, an operator can shatter, or fracture, a shale formation, which allows trapped hydrocarbons to flow to the wellbore.

Unconventional production techniques have led to new formation evaluation tools, including laboratory methods to evaluate the organic content of shales, and triaxial stress tests to determine how a shale will fracture under pressure. Detailed analysis of formation chemistry is also required to determine the impact of the fluids and sands being pumped to fracture the rock and hold the fractures open.

Key tools for the energy industry

Since its inception in the early 1920s, rock and fluid analysis in the energy industry has become a vast, multifaceted array of techniques used in oil fields, wellbores, laboratories, and offices to help guide business decisions and technical choices. Ongoing development of new techniques enables energy companies to provide reliable supplies of oil and gas to the world economy.