Each year, Lab Manager conducts a survey to gain insight into our readers’ purchasing and budget plans. The data collected show trends and challenges that are common across the scientific industry, despite how diverse our audience is in lab type, area of research, and lab size. Similar to last year’s survey, this year’s results from hundreds of participants show there are still lingering effects of the COVID-19 pandemic among lab operations. For example, 51 percent of respondents said they have stockpiled supplies and reagents this year in response to the pandemic, and 22 percent invested in software to accommodate remote work. Other factors influencing the business management of labs include rising inflation costs and shifting workforce trends.

Changes in budget

We asked our readers how their budget has changed in 12 areas compared to the previous year. Out of the 12 areas—which included things like hiring additional or replacement staff, raw materials, funding for new projects, education and training, and outsourcing, among others—all but one showed that most respondents either saw increases in their budget or it remained the same compared to 2021. “Traveling to trade shows, conferences, or meetings” was the only area where the majority of survey participants said that their budget either stayed the same (41 percent) or decreased (34 percent), which can likely be attributed to the COVID-19 pandemic.

Another interesting finding that stood out from the survey was about allocations for spending. When asked, “How has your spending on laboratory products changed in the current year compared to previous years?”, 50 percent said that their spending has increased compared to previous years, whereas 21 percent said spending decreased. Responses like this demonstrate that despite shutdowns, limited personnel, and supply chain struggles experienced since 2020, many labs have been able to bounce back and source the equipment they need.

This is further supported with responses to another question in the survey. When predicting budget changes over the next 12 months, respondents believe that there will be little to no decreases among the same 12 areas discussed above. This may come as a relief to some given the current state of the economy and inflation rates. For areas around staffing, such as “hiring additional and replacement staff,” 32 percent of respondents anticipate an increase in budget compared to 14 percent who expect a decrease. When asked about “management and staff compensation, benefits, etc.,” 27 percent expect an increase and just 10 percent expect a decrease. Focusing on hiring new staff and better compensating existing employees may be a sign of employers looking to improve retention and enhance the work environment for their employees, a trend being observed across the entire workforce.

Purchasing factors and considerations

There are a variety of reasons why a lab may look to purchase new equipment. Some of the most common responses among our survey participants when asked to comment on the significant reasons for purchasing in the next 12 months included:

• Replacing aging equipment

• To fulfill project needs, meet new goals, or to expand capabilities

• Building/moving into a new lab space

As we’ve consistently seen in previous years’ surveys, the majority (75 percent this year) of respondents say that a

new technology purchase is typically initiated by the lab manager or primary researcher making a request or proposal. However, according to the data, oftentimes it’s a research team member that initially identifies a problem or opportunity, then vocalizes it to the manager for approval.

These results solidify the importance of having an open line of communication between the lab manager and their team to ensure staff feel comfortable raising these requests and inefficiencies in the lab.

When it comes to identifying which factors or features influence a manager’s decision-making process when searching for products and services, the top three answers among our survey participants were:

• Long-term efficiency and operating costs (77 percent said it is “very important”)

• After-sale support, maintenance, and warranty (again, 77 percent said it is “very important” compared to less than one percent who said it’s “not important”)

• Price and value of vendor’s products (76 percent said it is “very important”)

A close runner up was “compatibility of vendor’s products with current systems,” which 75 percent listed as “very important” and 25 percent said “somewhat important.”

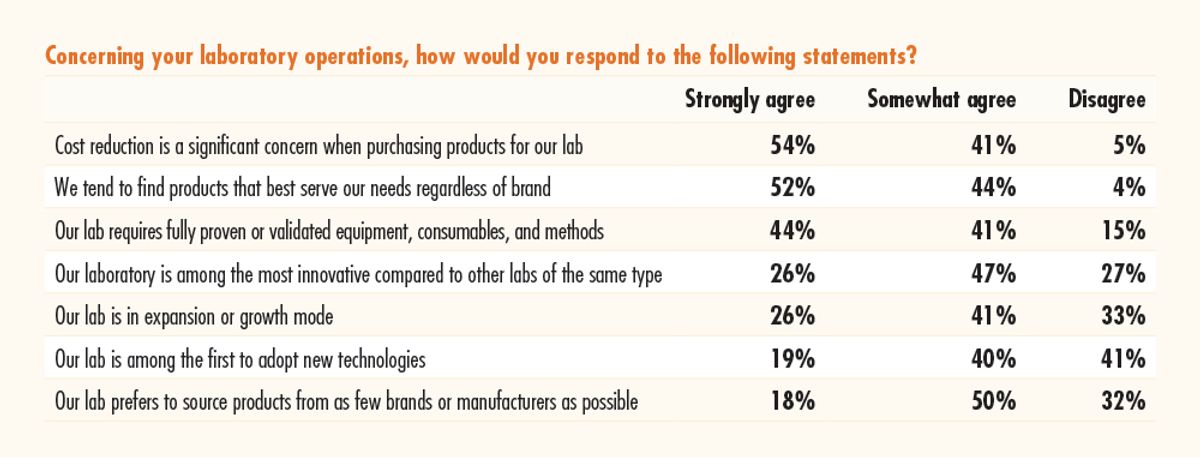

Additionally, brand names alone don’t hold much value among our survey participants when shopping for new instruments. Fifty-two percent “strongly agree” and 44 percent “somewhat agree” that they tend to find products that best serve their needs regardless of the brand.

The emphasis on long-term efficiency, value, and ongoing support shows how crucial it is for vendors to establish a positive relationship with their laboratory clients. The vendors that can establish trust and offer solutions to accommodate a wide range of needs will reap the benefits.

What to expect in 2023

According to this year’s survey, the effects of the economy have yet to make a significant mark on lab operations, though next year may be a different story.

Many respondents seem to be heading into the new year with similar if not more budget and resources than in recent previous years. It’s likely 2023 trends could see a continued emphasis on budgeting for staff compensation, training, and other people-focused factors, as well as investments in equipment or the use of outsourcing services as many labs expand their capabilities and offerings to reach new levels of growth.